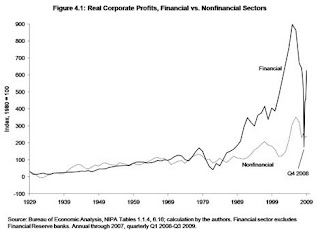

1. Financialization of the economy as the real corporate profits of the financial sector went ballistic since 1980

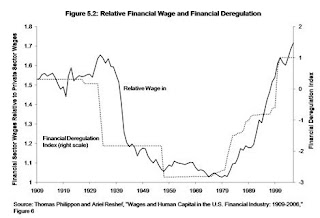

2. The average annual compensation in the banking sector (in real, inflation-adjusted terms) took off almost vertiginuosly in the eighties.

3. This "financialization" can be largely attributed to the dramatic de-regulation of the US financial markets. As James Kwak writes, the graph speaks for itself.

4. The consequence of all this has been a spurt in returns from economies of scale and a spectacular growth in the size of American banks, resulting in the "too-big-to-fail" problem.

Update 1 (9/5/2010)

Scott Winship overlays, the trend line showing the share of income received by the top one percent (the black line)(from Saez and Pikketty) on the deregulation chart in Sl No 3 and finds striking similarity.

No comments:

Post a Comment